Analysis of the Electric Bicycle Market in the United States

Over the past five years,electric bicycles have emerged as the strongest growth segment in the U.S.bicycle industry.Data from

Circana indicates that from 2019 to 2023,electric bicycles contributed 63%to the sales growth in the market,capturing a 20%share of

overall sales in 2023.They are also the fastest-growing category in the e-commerce sector of independent bicycle dealers(IBD).

(picture source: Peopleforbikes)

Momentum for Electric Bicycle Growth

Despite concerns about a slowing growth curve at the beginning of 2024,data from the second quarter suggests that the decline

in 2023 was a temporary adjustment following a peak in 2022.As of April 2024,unit sales of electric bicycles increased by 13%compared

to the same period in 2023.

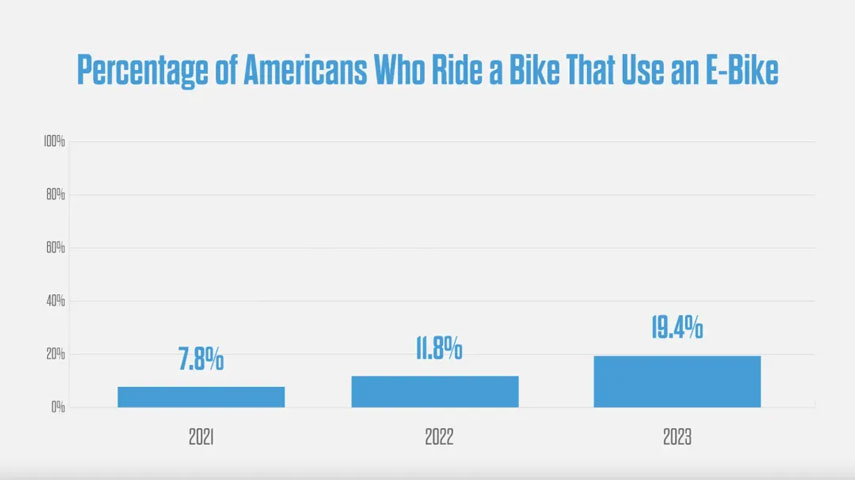

Sales data from Workstand show that online sales of electric bicycles surged by 60%year-over-year in April and May 2024,although

this was slightly lower than the 69%increase in 2022.Interest in electric bicycles is also rising,with a study revealing that by 2023,19.4%

of Americans who rode a bicycle had used an electric bike,up from 7.8% in 2021.

(picture source: Peopleforbikes)

Trends in Average Selling Prices

Electric bicycles demonstrate a varied pricing landscape.Circana reports that the average selling price(ASP)through specialized

channels(IBD)is about$3,055,while prices in other retail markets(ROM)can drop to$669.The sales growth rate in the ROM channel is

outpacing that of IBD,indicating that recreational riders are driving demand.Though ASPs in both channels have remained stable or

slightly declined—IBD ASP decreased by 5%in 2023—upcoming tariffs on imports from China may lead to higher prices.

(picture source: Peopleforbikes)

Demand for Low-End Used Bicycles

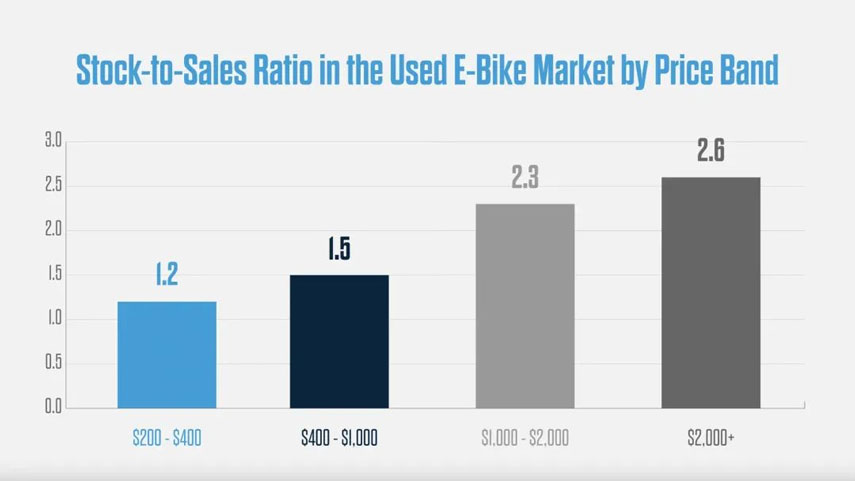

In the used electric bicycle market,lower-priced models are in high demand,while interest in higher-priced models is weak.Data from

May 2024 shows that electric bicycles priced between$200 and$400 have an inventory turnover ratio just above 1.0,indicating strong demand.

In contrast,the$1,000 to$2,000 price range sees a turnover ratio of 2.3,suggesting supply is beginning to exceed demand,and higher-priced

models stabilize at a ratio of about 2.6.

This trend may be influenced by discount strategies from retailers and DTC brands.The decline in new electric bicycle prices has affected

the demand for similar products in the used market.Sellers may attract buyers by adjusting prices closer to those of standard models,highlighting

that reasonably priced bicycles are more appealing.

(picture source: Peopleforbikes)

Surge in Online Sales

Workstand's data indicates that e-commerce sales of electric bicycles are growing faster than the overall IBD channel.Only about 2%

of electric bicycles were sold online in the first quarter of 2024,but the annual growth rate reached 45%,reflecting a shift in consumer

purchasing preferences.Most e-commerce sales involve in-store pickups,combining the convenience of online shopping with quality service

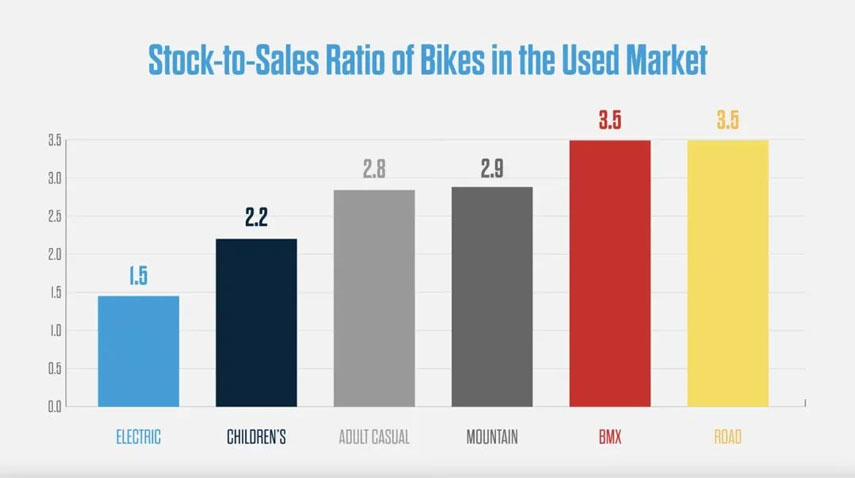

at physical stores.Additionally,electric bicycles are performing well in the used market,with lower inventory turnover ratios than traditional

bicycles,and their sales growth is surpassing that of standard bikes.